SMM News on June 23:

Primary Aluminum Imports: According to data from the General Administration of Customs, domestic primary aluminum imports in May 2025 were approximately 223,200 mt, down 10.9% MoM and up 41.4% YoY. From January to May, cumulative domestic primary aluminum imports totaled about 1.0575 million mt, down 3.7% YoY.

Primary Aluminum Exports: According to data from the General Administration of Customs, domestic primary aluminum exports in May 2025 were approximately 32,000 mt, up 136.9% MoM and up 376.4% YoY. From January to May, cumulative domestic primary aluminum exports totaled about 67,000 mt, up approximately 215.6% YoY.

Net Primary Aluminum Imports: In May 2025, domestic net primary aluminum imports were 190,700 mt, down 19.5% MoM and up 26.3% YoY. From January to May, cumulative domestic net primary aluminum imports were approximately 990,500 mt, down 8.0% YoY. (The above import and export data are based on HS codes 76011090 and 76011010.)

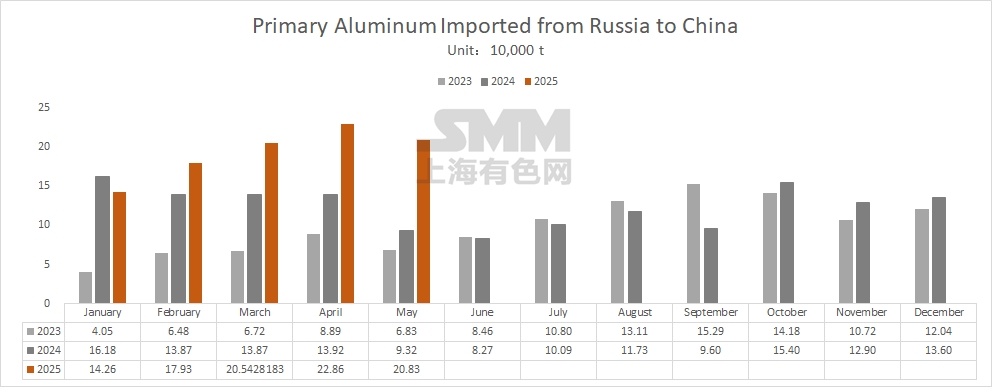

From the perspective of import source countries, the main sources of domestic primary aluminum imports in May 2025 were the Russian Federation, Indonesia, India, Malaysia, Australia, Iran, and other countries and regions. Among them, the total primary aluminum imports from Russia in May were approximately 208,300 mt, increasing by 12.44% MoM again, accounting for 93.3% of May's imports. Currently, overseas primary aluminum imports are in a loss-making state, with import losses oscillating around 1,000 yuan/mt. Weak overseas demand and continuous destocking in China have stimulated overseas supplies to enter the Chinese market. However, from the perspective of the spot market, domestic demand has entered the off-season, and coupled with high aluminum prices, downstream purchase intentions are poor. Some imported supplies have seen significant discounts in the spot market but have still seen few transactions.

From the perspective of trade modes: In terms of primary aluminum import trade modes in May, Ordinary Trade, Entry and Exit Goods in Bonded Control Areas, and Processing with Imported Materials showed MoM growth. SMM has learned that some domestic processing plants have recently added manual processing businesses, but due to the need for customs approval and numerous restrictions on manual processing, the overall growth in volume is currently limited.

SMM Commentary: Currently, aluminum prices still maintain the trend of overseas market outperforming domestic market. The domestic import window is closed, and import losses are oscillating around 1,000 yuan/mt. Coupled with weak overseas demand, the willingness of overseas aluminum ingots to enter the Chinese market remains. However, due to the domestic demand off-season and insufficient downstream consumption capacity, it is expected that there will be limited growth in net primary aluminum imports in June.